Emergency Rental Assistance: Secure Up to 6 Months Aid Before 2025

Emergency rental assistance programs provide critical financial support, offering up to six months of aid to eligible individuals and families facing housing instability, with crucial application deadlines approaching before 2025.

Are you struggling to keep up with rent payments? Many Americans face unprecedented financial challenges, making stable housing a constant concern. Fortunately, emergency rental assistance programs offer a lifeline, providing crucial support to help you stay in your home. Understanding how to access these vital funds, and more importantly, the impending deadlines before 2025, is essential for securing your housing stability.

Understanding Emergency Rental Assistance Programs

Emergency rental assistance programs, often abbreviated as ERA, were primarily established to help households struggling to pay rent and utilities due to financial hardships. These programs gained significant traction during economic downturns, offering a safety net for millions. The core objective is to prevent evictions, maintain housing stability, and alleviate the burden on families facing unexpected financial crises, and they continue to be a crucial resource for many across the United States.

Initially funded through federal allocations, these programs are typically administered at the state, county, or city level, leading to variations in specific eligibility criteria and application processes. This decentralized approach means that while the overarching goal remains consistent, the details of how aid is distributed and who qualifies can differ significantly depending on your location. It’s not a one-size-fits-all solution, requiring applicants to identify their local program.

The Genesis and Evolution of ERA

The concept of emergency rental assistance isn’t new, but its recent widespread implementation and substantial funding largely stem from legislative responses to major crises. These programs have evolved, adapting to changing economic landscapes and housing needs. Understanding their origins helps in appreciating their current structure and importance.

- Federal Funding: Significant federal acts provided billions in relief.

- Local Administration: States and localities manage distribution.

- Preventing Evictions: A primary goal to avoid homelessness.

- Utility Support: Often includes assistance for essential utilities.

The flexibility embedded within these programs allows local administrators to tailor their offerings to the specific needs of their communities. This can include prioritizing certain demographics, adjusting income thresholds, or offering different types of support beyond just rent, such as utility arrears or even future rent payments for a limited period. The ongoing evolution ensures that these programs remain relevant and impactful.

In conclusion, emergency rental assistance programs are a vital component of the social safety net, designed to provide immediate financial relief to those at risk of losing their housing. Their structure, while varied, is fundamentally geared towards preventing homelessness and promoting stability. Recognizing the nuances of these programs is the first step toward successfully accessing the aid they offer.

Who Qualifies for Rental Assistance? Eligibility Criteria Explained

Determining eligibility for emergency rental assistance can seem complex, but generally, programs share common foundational requirements. The primary aim is to assist households that have experienced financial hardship, are at risk of homelessness or housing instability, and meet specific income thresholds. Understanding these criteria is paramount before initiating an application, as it can save significant time and effort.

Most programs require applicants to demonstrate a loss of income, increased expenses, or other financial setbacks directly related to an economic event, such as a job loss, reduced work hours, or significant medical bills. This hardship must often be recent and verifiable. Additionally, tenants usually need to provide proof of residency and a valid lease agreement to confirm their rental obligation.

Income Thresholds and Household Composition

A critical component of eligibility is the household’s income. Programs typically set income limits based on a percentage of the Area Median Income (AMI), often 80% or less, though this can vary by program and location. The number of people in your household also plays a role in determining the applicable income threshold, as larger households generally have higher limits.

- Area Median Income (AMI): Often 80% or below of your local AMI.

- Household Size: Income limits adjust based on the number of residents.

- Recent Financial Hardship: Must demonstrate a qualifying financial setback.

- Risk of Housing Instability: Eviction notice or past-due rent statements are common proofs.

Documentation is key to proving eligibility. This includes pay stubs, tax returns, unemployment benefit letters, bank statements, and eviction notices or past-due rent statements. Having these documents organized and readily available will streamline the application process significantly. Some programs may also require proof of identity for all adult household members.

In summary, while specific requirements may differ, the core eligibility for emergency rental assistance revolves around demonstrating financial hardship, meeting income limits, and proving a risk of housing instability. Thorough preparation of documentation and a clear understanding of your local program’s criteria are crucial for a successful application.

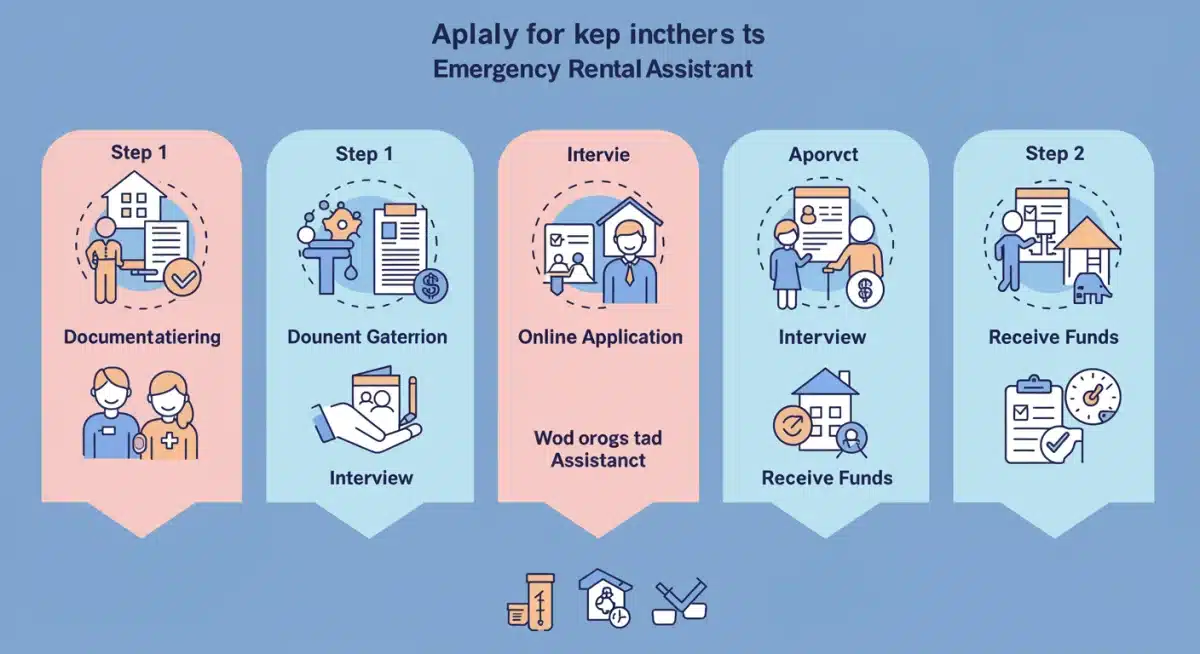

The Application Process: Step-by-Step Guide to Receiving Aid

Navigating the application process for emergency rental assistance can be daunting, but breaking it down into manageable steps makes it more accessible. While specific platforms and required documents may vary by location, a general roadmap applies across most programs. The key is to be organized, thorough, and proactive in gathering all necessary information.

The first step is always to identify the correct program for your area. This typically involves visiting your state or local government’s housing authority website or calling 211 for assistance. Once you’ve located the appropriate program, review their specific eligibility criteria and gather all required documentation. This preparatory phase is crucial for a smooth application.

Gathering Essential Documents

Before you even begin filling out forms, compile a comprehensive set of documents. This will include personal identification, proof of income, rental agreement details, and evidence of financial hardship. Missing documents are a common cause of delays or rejections, so take this step seriously.

- Proof of Identity: IDs for all adult household members.

- Income Verification: Pay stubs, tax returns, unemployment letters.

- Lease Agreement: A copy of your current rental contract.

- Proof of Hardship: Eviction notice, past-due utility bills, medical bills.

- Bank Statements: Recent statements to show financial status.

Once your documents are ready, proceed to the application itself. Many programs offer online portals, which are often the quickest way to apply. Fill out all sections accurately and completely. Be prepared to answer questions about your household composition, income, expenses, and the specific nature of your financial hardship. After submission, you may be contacted for an interview or to provide additional information, so monitor your communication channels closely.

In essence, the application process for emergency rental assistance requires careful attention to detail and proactive preparation. By identifying the right program, meticulously gathering all required documents, and completing the application accurately, you significantly increase your chances of receiving the aid you need.

Maximizing Your Aid: Understanding the Up to 6 Months Provision

One of the most significant benefits of emergency rental assistance programs is the potential to receive up to six months of aid, which can be a game-changer for households facing long-term financial recovery. However, understanding how this provision works and what factors influence the duration and amount of assistance is crucial for maximizing the support you receive. It’s not always a guaranteed six months, but rather a maximum potential.

The ‘up to six months’ often refers to a combination of past-due rent and future rent payments. Programs typically prioritize covering arrears first, to prevent immediate eviction. Once past-due amounts are settled, some programs may then offer prospective rent payments, ensuring continued housing stability while the household works to regain financial footing. This staggered approach aims to provide both immediate relief and a bridge to self-sufficiency.

Factors Influencing Aid Duration and Amount

Several factors determine how much aid you receive and for how long. The availability of funds within the local program plays a significant role, as does your specific financial situation and the cost of your rent. Some programs may have caps on the total amount of assistance or the number of months they can cover, even if you remain eligible.

- Program Funding: Availability of funds can impact duration.

- Household Need: Your specific financial situation assessed.

- Rent Cost: Higher rents may reach program caps faster.

- Local Policies: Specific rules set by state or local administrators.

It’s important to note that many programs require re-evaluation after an initial period, typically three months, to determine continued eligibility for the remaining aid. This often involves submitting updated income information and hardship documentation. Being proactive in providing these updates ensures uninterrupted support. Don’t assume the full six months will be automatically granted; plan for reviews.

Ultimately, maximizing your emergency rental assistance means understanding the program’s limits, actively communicating with administrators, and diligently providing any requested follow-up documentation. This proactive approach ensures you leverage the ‘up to six months’ provision to its fullest potential, providing a stable foundation for your recovery.

Crucial Deadlines: Why Acting Before 2025 is Imperative

The urgency surrounding emergency rental assistance programs cannot be overstated, especially with critical deadlines approaching before 2025. Many of these programs operate on finite funding cycles, and as funds are depleted or legislative mandates expire, the availability of aid can diminish significantly or cease entirely. Therefore, understanding these deadlines and acting swiftly is absolutely imperative.

While some federal funding sources have been extended or replenished, the nature of these programs means that local administrators are constantly managing their budgets. Once a program’s allocated funds are exhausted, it may stop accepting new applications, even if the official ‘end date’ is still some time away. This makes early application a strategic move, rather than waiting until the last minute.

Tracking Local and State Deadlines

Because emergency rental assistance is largely administered locally, there isn’t a single national deadline that applies to everyone. Instead, you must diligently track the specific deadlines and funding status of programs in your state, county, or city. This often requires regularly checking official government websites or contacting program administrators directly.

- State Housing Authority Websites: Primary source for state-level deadlines.

- County/City Program Pages: Check local government sites for specific deadlines.

- 211 Service: A great resource for up-to-date local information.

- Community Organizations: Often have current information on local aid availability.

Beyond formal application deadlines, it’s also crucial to consider the processing times. Applications can take several weeks or even months to process, especially during periods of high demand. Submitting your application well in advance of any stated cutoff gives you a better chance of approval and receiving funds before they run out. Don’t underestimate the time required for a complete review process.

In conclusion, the approaching 2025 timeframe serves as a critical reminder for anyone in need of emergency rental assistance. Proactive engagement, diligent tracking of local deadlines, and early application are not just advisable but essential strategies to ensure you don’t miss out on vital support designed to keep you housed.

Beyond Rent: Additional Support and Resources Available

While emergency rental assistance programs primarily focus on rent and utility payments, the support landscape for individuals and families facing housing instability extends much further. Understanding these additional resources can provide a more comprehensive safety net, addressing underlying issues that contribute to financial precarity and helping to build long-term stability. It’s about more than just a single payment.

Many organizations and government agencies offer a range of services designed to complement rental assistance. These can include financial counseling, job placement services, legal aid for eviction prevention, and connections to food assistance programs. A holistic approach to support recognizes that housing stability is often intertwined with other aspects of a person’s well-being.

Connecting with Community Services

Local community organizations are often invaluable hubs for connecting individuals with various forms of aid. These groups often have strong relationships with local government programs and can provide personalized guidance through complex application processes. They might also offer direct services that address immediate needs beyond rent, such as clothing or transportation assistance.

- Financial Counseling: Help with budgeting, debt management, and financial planning.

- Job Placement Services: Assistance with resume building, job searching, and interview skills.

- Legal Aid: Free or low-cost legal representation for eviction cases.

- Food Banks: Access to nutritious food to reduce household expenses.

- Utility Assistance Programs: Separate programs specifically for energy and water bills.

Furthermore, some rental assistance programs may collaborate with these support services, offering referrals or integrated case management. This means that by applying for rental aid, you might automatically gain access to other beneficial resources. Always inquire about additional support when you communicate with program administrators or case managers.

In summary, while securing emergency rental assistance is a critical step, remember that a broader network of support exists. By exploring and utilizing these additional resources, you can not only address immediate housing needs but also build a more stable and resilient financial future for yourself and your family.

Preparing for the Future: Long-Term Housing Stability Strategies

Receiving emergency rental assistance provides crucial short-term relief, but true housing security requires a focus on long-term stability strategies. Relying solely on temporary aid is not sustainable; developing resilient financial habits and understanding available resources for ongoing support are key. This forward-thinking approach helps individuals transition from crisis management to proactive planning.

One of the most effective strategies is to focus on improving financial literacy and budgeting skills. Understanding how to manage income, track expenses, and save for emergencies can significantly reduce the likelihood of future housing crises. Many community organizations and non-profits offer free workshops and one-on-one counseling to help individuals develop these essential skills.

Building a Financial Safety Net

Creating an emergency fund is perhaps the most critical component of long-term housing stability. Even a small amount saved can prevent a missed rent payment during unexpected setbacks. Alongside savings, exploring opportunities for income diversification or skill development can enhance earning potential and provide greater financial flexibility.

- Emergency Savings: Aim to build at least 3-6 months of living expenses.

- Budgeting: Track income and expenses to identify areas for saving.

- Debt Reduction: Prioritize paying off high-interest debts to free up cash flow.

- Skill Development: Invest in training or education to improve job prospects.

- Credit Building: A good credit score can open doors to better housing and financial products.

Additionally, staying informed about tenant rights and responsibilities is vital. Knowing your rights can empower you to navigate landlord-tenant issues effectively, while understanding your responsibilities helps maintain a positive rental history. Resources like local legal aid societies or tenant unions can provide valuable information and support in this area.

In conclusion, while emergency rental assistance offers a temporary solution, achieving lasting housing stability requires a multi-faceted approach. By focusing on financial literacy, building an emergency fund, and staying informed about tenant rights, individuals can lay a strong foundation for a secure and stable housing future, moving beyond the immediate need for aid.

| Key Point | Brief Description |

|---|---|

| Program Overview | Emergency Rental Assistance (ERA) helps households with rent and utilities due to financial hardship, preventing evictions. |

| Eligibility | Generally requires financial hardship, risk of instability, and income below 80% Area Median Income (AMI). |

| Aid Duration | Programs can provide up to 6 months of aid, covering past-due and future rent, often requiring re-evaluation. |

| Deadlines | Deadlines vary by state and locality; early application is critical as funds are finite and often depleted before official end dates. |

Frequently Asked Questions About Rental Assistance

Emergency rental assistance (ERA) is financial aid designed to help individuals and families pay for rent and utility costs when they are experiencing financial hardship. Its primary goal is to prevent evictions and ensure housing stability, particularly during economic crises or unexpected personal setbacks. Programs are usually administered at local levels.

Many emergency rental assistance programs offer support for up to six months. This typically covers a combination of past-due rent and future rental payments. The exact duration depends on the specific program’s funding, your continued eligibility, and local policies, often requiring periodic re-evaluation of your financial situation.

You’ll generally need proof of identity for all adults, income verification (pay stubs, tax returns), a copy of your lease agreement, and documentation of financial hardship (eviction notice, past-due utility bills, medical bills). Having these ready streamlines your application process considerably.

Yes, deadlines are crucial and vary significantly by state, county, and city. Many programs have finite funding, meaning they may stop accepting applications before official end dates if funds are depleted. It is imperative to check your local program’s website or contact them directly for current deadlines and funding status, especially before 2025.

You can typically find information about your local emergency rental assistance program by visiting your state or local government’s housing authority website. Additionally, calling 211 is an excellent resource for connecting with local social services, including rental aid programs and other community support organizations in your area.

Conclusion

The landscape of emergency rental assistance programs offers a vital lifeline for countless Americans striving to maintain stable housing. With deadlines for many programs approaching before 2025, understanding the eligibility criteria, navigating the application process, and acting promptly are more crucial than ever. While these programs provide immediate relief, fostering long-term financial stability through budgeting, savings, and utilizing additional community resources remains paramount. By taking proactive steps today, individuals and families can secure their housing and build a more resilient future, ensuring they don’t miss out on essential aid.