Smart Debt Management 2026: Cut Interest by 10% Annually

Implementing smart debt management in 2026, by utilizing advanced digital tools and strategic repayment methods, offers individuals a realistic pathway to reduce their interest payments by an average of 10% annually.

Are you looking to take control of your finances and significantly reduce your debt burden? In 2026, mastering smart debt management is more crucial than ever, offering pathways to cut your interest payments by an average of 10% annually. This guide will explore the most effective strategies and tools available to empower you on your financial journey.

Understanding the 2026 Financial Landscape and Debt

The financial world in 2026 presents both challenges and unparalleled opportunities for those looking to manage their debt intelligently. Economic shifts, technological advancements, and evolving consumer behaviors all play a significant role in how we approach personal finance. Understanding these dynamics is the first step towards crafting an effective debt management strategy.

Interest rates, inflation, and the overall job market continue to influence borrowing costs and repayment capacities. Staying informed about these macroeconomic factors allows individuals to make proactive decisions rather than reactive ones. For instance, anticipating interest rate hikes can prompt earlier debt consolidation or refinancing efforts.

Key Economic Indicators to Monitor

To effectively navigate the 2026 financial landscape, it’s essential to keep an eye on specific economic indicators that directly impact debt. These indicators provide valuable insights into potential changes in borrowing costs and the overall economic climate.

- Federal Reserve Interest Rate Forecasts: These predictions offer a glimpse into future borrowing costs for loans and credit cards.

- Inflation Rates: High inflation can erode purchasing power and make debt repayment more challenging if incomes don’t keep pace.

- Unemployment Data: A strong job market generally means more financial stability, making debt management easier.

- Consumer Spending Trends: These trends can indicate economic health and consumer confidence, indirectly affecting lending practices.

By regularly monitoring these indicators, individuals can better anticipate market changes and adjust their debt management strategies accordingly. This proactive approach is a cornerstone of smart financial planning in today’s dynamic environment.

In conclusion, the 2026 financial landscape demands a keen understanding of economic forces and their direct impact on personal debt. By staying informed and recognizing key indicators, individuals can lay a solid foundation for reducing their interest payments and achieving financial stability.

Leveraging AI and Automation for Debt Reduction

The advent of artificial intelligence (AI) and automation has revolutionized how we approach personal finance, making smart debt management more accessible and efficient than ever before. In 2026, these technologies are no longer just futuristic concepts but practical tools that can significantly enhance your ability to cut interest payments.

AI-powered financial assistants can analyze your spending patterns, identify opportunities for savings, and even suggest optimal debt repayment strategies. Automation, on the other hand, ensures consistent progress by setting up automatic payments and transfers, minimizing the risk of missed payments and late fees.

AI-Powered Debt Management Tools

Numerous AI tools are emerging in 2026, designed to simplify and optimize debt management. These tools go beyond basic budgeting apps, offering sophisticated analysis and personalized recommendations.

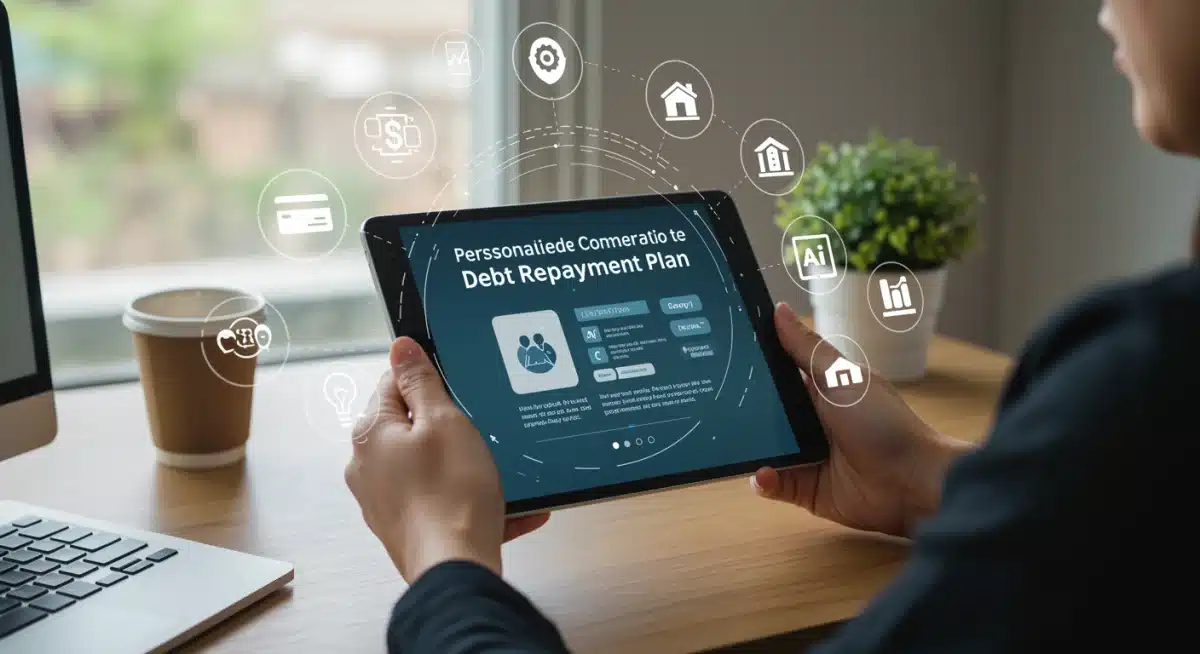

- Predictive Analytics: AI can forecast future financial scenarios based on your current habits and market trends, helping you prepare for potential challenges.

- Personalized Repayment Plans: These tools craft tailored repayment schedules that prioritize high-interest debts while considering your cash flow.

- Automated Negotiation: Some advanced AI platforms can even assist in negotiating lower interest rates with creditors on your behalf.

The integration of AI into debt management means less manual effort and more data-driven decisions. This allows individuals to focus on their financial goals with greater confidence, knowing that advanced algorithms are working to optimize their strategies.

Automating bill payments and transfers to savings or debt repayment accounts is a simple yet powerful way to ensure consistency. This not only helps avoid late fees but also builds discipline, which is crucial for long-term financial health. The combination of AI for strategic insights and automation for execution creates a robust system for achieving significant interest savings.

Ultimately, leveraging AI and automation in 2026 offers a significant advantage in the quest for smart debt management. These technologies provide the intelligence and consistency needed to effectively reduce interest payments and accelerate debt freedom.

Strategic Debt Consolidation and Refinancing Options

Debt consolidation and refinancing remain powerful tools in the arsenal of smart debt management, especially in 2026’s dynamic financial environment. These strategies can significantly lower your overall interest payments by combining multiple debts into a single, more manageable loan or by securing a lower interest rate on existing debt.

The key to success lies in understanding when and how to utilize these options effectively, considering your credit score, current interest rates, and long-term financial goals. A well-executed consolidation or refinancing plan can provide immediate relief and a clearer path to debt freedom.

Exploring Consolidation Loans

A debt consolidation loan allows you to take out a new loan to pay off several existing debts, typically with a lower interest rate and a single monthly payment. This simplifies your finances and can lead to substantial savings over time.

- Personal Loans: Unsecured personal loans are a common choice for consolidating credit card debt, often offering fixed interest rates.

- Balance Transfer Credit Cards: These cards offer an introductory 0% APR period, allowing you to pay down debt without accruing interest for a specific timeframe.

- Home Equity Loans/Lines of Credit (HELOCs): If you own a home, using your home equity can provide lower interest rates, but it also puts your home at risk if you default.

Before opting for consolidation, carefully compare interest rates, fees, and repayment terms. Ensure the new loan genuinely offers a better deal and doesn’t extend your repayment period unnecessarily, which could lead to paying more in interest over the long run.

Refinancing, on the other hand, involves replacing an existing loan with a new one that has more favorable terms, such as a lower interest rate or a shorter repayment period. This is particularly common for mortgages and student loans.

The decision to consolidate or refinance should always be based on a thorough analysis of your financial situation and a clear understanding of the potential benefits and risks. Consulting with a financial advisor can provide valuable insights and help you choose the best option for your specific needs.

In essence, strategic debt consolidation and refinancing are vital components of smart debt management in 2026, offering tangible ways to reduce interest costs and streamline your repayment process.

Budgeting and Spending Habits in the Digital Age

Effective budgeting and mindful spending habits remain foundational to any successful smart debt management plan, even with the advanced tools available in 2026. While AI can offer insights, the discipline of tracking income and expenses is paramount to identifying areas for improvement and ensuring your debt reduction efforts are sustainable.

The digital age has brought forth an array of budgeting apps and platforms that make this process easier than ever. These tools provide real-time tracking, categorization of expenses, and visual representations of your financial flow, empowering you to make informed decisions about your money.

Modern Budgeting Strategies

Beyond traditional spreadsheets, contemporary budgeting strategies leverage technology to provide a more dynamic and less tedious approach to managing your money.

- Zero-Based Budgeting Apps: Every dollar is assigned a job, ensuring no money is unaccounted for and maximizing its impact on debt repayment.

- Envelope System Digitized: Modern apps mimic the classic envelope system by allocating funds to digital categories, preventing overspending in specific areas.

- Gamified Budgeting: Some platforms turn budgeting into a game, offering rewards and challenges to encourage responsible spending and saving.

Understanding where your money goes is the first step towards controlling it. By categorizing your expenses, you can identify non-essential spending that can be reallocated towards debt payments, directly contributing to cutting interest. This granular view of your finances is critical for making meaningful changes.

Mindful spending goes hand-in-hand with effective budgeting. It involves making conscious choices about purchases, distinguishing between needs and wants, and avoiding impulse buying. In an era of instant gratification, developing this discipline is more important than ever. Setting spending limits and regularly reviewing your budget can help reinforce these habits.

In summary, while 2026 offers sophisticated financial technologies, the core principles of budgeting and mindful spending are indispensable for smart debt management. These practices, combined with digital tools, create a powerful framework for reducing interest payments and achieving financial freedom.

Negotiating with Creditors and Financial Institutions

Direct negotiation with creditors and financial institutions is a often-overlooked yet highly effective strategy in smart debt management. Many individuals assume that interest rates and repayment terms are fixed, but in 2026, there is often room for discussion, especially if you have a good payment history or are facing genuine financial hardship.

Approaching your creditors with a clear understanding of your financial situation and a well-thought-out proposal can lead to significant reductions in interest rates, adjusted payment schedules, or even temporary hardship programs. This proactive step can directly contribute to cutting your annual interest payments.

Effective Negotiation Tactics

Successful negotiation requires preparation, clear communication, and a realistic understanding of what you can achieve. Here are some tactics to consider when speaking with your creditors:

- Prepare Your Financial Snapshot: Have your income, expenses, and current debt balances readily available to present a clear picture of your situation.

- Highlight Good Payment History: If you’ve been a reliable customer, emphasize this as a reason for them to work with you.

- Propose a Realistic Plan: Offer a specific, affordable payment plan or a requested interest rate reduction.

- Be Persistent and Polite: Don’t get discouraged if your first attempt isn’t successful; politely follow up and explore different avenues.

It’s important to remember that financial institutions prefer to work with you to recover their funds rather than have you default on your debt. They may be willing to offer concessions such as a lower Annual Percentage Rate (APR), waiving late fees, or extending your repayment period, all of which can reduce your overall interest burden.

For more substantial debt challenges, exploring options like debt management plans (DMPs) through credit counseling agencies can be beneficial. These agencies can negotiate on your behalf, often securing lower interest rates and consolidating payments into one monthly sum, making debt repayment more manageable.

Ultimately, engaging in direct and informed negotiation with your creditors is a powerful component of smart debt management in 2026. It empowers you to actively seek better terms and reduce your interest payments, rather than passively accepting the status quo.

Future-Proofing Your Finances: Beyond 2026

While focusing on smart debt management in 2026 is crucial, the ultimate goal is to future-proof your finances, ensuring long-term stability and resilience against unforeseen economic shifts. This involves building sustainable habits, diversifying income streams, and staying adaptable to emerging financial technologies and market trends.

Achieving a 10% annual reduction in interest payments is a significant milestone, but maintaining that momentum requires a forward-thinking approach. It’s about creating a financial ecosystem that supports continuous growth and minimizes future debt accumulation.

Long-Term Financial Resilience Strategies

Building financial resilience involves more than just paying off debt; it’s about establishing a robust framework that can withstand economic turbulence and support your long-term goals.

- Emergency Fund Expansion: Beyond covering a few months of expenses, aim for a larger fund that can handle significant life events without resorting to high-interest debt.

- Diversified Investments: Explore various investment avenues beyond traditional stocks and bonds, including alternative assets or passive income streams.

- Continuous Financial Education: Stay updated on personal finance best practices, investment opportunities, and changes in tax laws or economic policies.

- Regular Financial Reviews: Periodically assess your budget, debt, and investments to ensure they align with your evolving goals and the current economic climate.

Embracing a mindset of continuous learning and adaptation is key. The financial world is constantly evolving, with new products, services, and regulatory changes emerging regularly. Staying informed and being willing to adjust your strategies will ensure your financial plans remain relevant and effective.

Consider the role of sustainable investing and ethical finance, which are gaining significant traction in 2026. Aligning your financial decisions with your values can not only provide personal satisfaction but also potentially offer stable returns in the long run.

In conclusion, future-proofing your finances extends beyond immediate debt reduction. It encompasses building a resilient financial foundation, continuously educating yourself, and adapting to the evolving economic landscape, ensuring lasting financial well-being well beyond 2026.

| Key Strategy | Brief Description |

|---|---|

| Leverage AI Tools | Utilize AI for personalized repayment plans, predictive analytics, and automated financial management. |

| Strategic Consolidation | Combine high-interest debts into a single loan with a lower interest rate, simplifying payments. |

| Negotiate with Creditors | Proactively seek lower interest rates or adjusted payment terms with your financial institutions. |

| Mindful Budgeting | Implement digital budgeting tools and practice conscious spending to reallocate funds to debt repayment. |

Frequently Asked Questions About Smart Debt Management

The main goal is to strategically reduce your overall debt burden and, more specifically, to cut your annual interest payments by a significant margin, aiming for an average of 10% or more. This is achieved through informed decision-making and leveraging modern financial tools.

AI assists by analyzing your spending, identifying optimal repayment strategies, and even predicting future financial trends. Some advanced AI tools can automatically rebalance payments or suggest the best time for refinancing, directly impacting your interest accrual.

Debt consolidation can be highly effective, but it’s not a one-size-fits-all solution. It’s best when you can secure a lower interest rate and commit to the new payment plan. Always compare fees and terms to ensure it genuinely benefits your financial situation long-term.

Budgeting remains fundamental. While tools offer insights, your active participation in tracking income and expenses ensures you understand your financial flow. This personal oversight allows you to make conscious choices, reallocate funds, and reinforce healthy spending habits, complementing automated solutions.

It’s advisable to review your debt management strategy at least annually, or whenever there’s a significant change in your income, expenses, or market interest rates. Regular reviews ensure your plan remains aligned with your financial goals and current economic realities.

Conclusion

Embracing smart debt management in 2026 is not merely about cutting costs; it’s about empowering yourself with knowledge, leveraging innovative tools, and adopting disciplined habits to achieve lasting financial freedom. By strategically utilizing AI, exploring consolidation, actively negotiating with creditors, and maintaining diligent budgeting, individuals can realistically aim to reduce their interest payments by an average of 10% annually. This journey requires commitment and adaptability, but the rewards of a lighter debt burden and enhanced financial security are well within reach for those willing to take proactive steps in today’s evolving economic landscape.